Having been off the ‘speaker circuit’ for the last couple years, I have had a hard time prioritizing virtual conferences while focused on relaunching the eDiscovery Journal. Logikcull asked for me to cover their InHouse 2020 virtual networking event and frankly some of the corporate focused sessions looked interesting. Between accepting their invitation and the event my clients and a research engagement consumed that time, to my regret. However, the Logikcull team was kind enough to send me highlights and I spent some after hours time catching back up on the first cloud eDiscovery SaaS product (2004). [Logikcull clarification – Logikcull.com was launched April 2013, still the first SaaS eDiscovery platform to market]

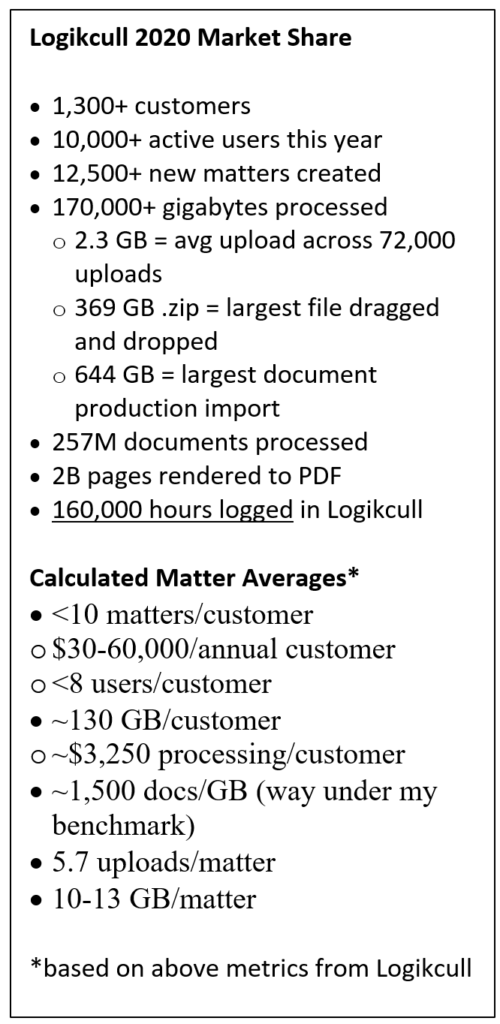

After 16 years Logikcull’s customer metrics tell me that they are still primarily serving the SMB market despite some very large Fortune 500 logos on their ubiquitous brag slide (names private by request). Their 2020 customer metrics and pricing model make for some interesting calculation averages. The averages indicate that the vast majority of Logikcull customer matters fall below the ‘loss leader’ threshold for most traditional service providers or enterprise licensed eDiscovery platforms. Therefore, Logikcull and the other self-service cloud SaaS providers fill a void in the eDiscovery market. They provide a straightforward service at a published, fixed cost. I imagine their Fortune 500 customers use Logikcull on small matters instead of legacy desktop software such as Summation Blaze or Concordance.

After 16 years Logikcull’s customer metrics tell me that they are still primarily serving the SMB market despite some very large Fortune 500 logos on their ubiquitous brag slide (names private by request). Their 2020 customer metrics and pricing model make for some interesting calculation averages. The averages indicate that the vast majority of Logikcull customer matters fall below the ‘loss leader’ threshold for most traditional service providers or enterprise licensed eDiscovery platforms. Therefore, Logikcull and the other self-service cloud SaaS providers fill a void in the eDiscovery market. They provide a straightforward service at a published, fixed cost. I imagine their Fortune 500 customers use Logikcull on small matters instead of legacy desktop software such as Summation Blaze or Concordance.

So on to the new platform announcements (Logikcull’s kind summary) and my comments.

- New product launch: Logikcull Hold (pricing here)

- eDJ-Pretty classic legal hold notification and tracking for $7,200 annual for 10 matters or free to try one matter on.

- New cloud storage option: Polycloud; process in Amazon, store in Microsoft

- eDJ-I like the ability to decide where your data resides. Concerned that all data must be processed in the US. Seems like that may violate GDPR data transfer rules.

- New search filters: Full email address faceting in search (backwards compatible to all existing 50k+ matters hosted in Logikcull)

- eDJ-Custodial address/name variations have always been a pain point. Does the user have to build the alias list? Because I do not see any other analytics in the platform.

- New user interface: Re-written in React, 5-10x faster page loading, easier and more modern design – Launching 12/15/2020

- eDJ-I will review this when it is live.

- New user role: Pro user role; semi-admin role where Pro users can create their own tags, fields, and redaction labels

- eDJ-I am sure that this was a hot request in a DIY environment. Trying to balance self service against data leak risks.

- New native+ database import w/auto PDFing: Document productions that lack TIFs or PDFs can be automatically rendered to PDF on upload

- eDJ-The devil is in the auto-OCR details. Early adopters tend to go with a ‘zero text extracted’ trigger. More mature features will OCR embedded images. [Logikcull confirmed that their auto-OCR extracts and OCRs embedded images and other files]

- New MS O365 integration: Easily ingest and process emails from O365 using the Graph API from directly within Logikcull

- eDJ-Collect owned mailbox, calendar, Teams & OneDrive with only date range limits based on the screenshot. Useful for raw dumps and I am sure that it will increase Logikcull’s average upload size quickly. Mild concern for DIY customers who assume that object ownership in M365 is a simple or accurate indicator of a complete custodian collection.

Logikcull, DISCO and other Cloud SaaS platforms can meet the self-service needs of customers on matters that do not justify the cost or complexity of platforms built for more typical corporate litigation discovery. What do I consider to be typical? It has been a while since I was running surveys on this, but I routinely see clients with collections covering 5-10 custodians with 10-250 GB of data each. I have single clients with more data hosted than Logikcull’s 170 TB*. They are atypical, but big stakes often equate to big data that requires complex normalization, TAR/PC, automated redaction and mature review batch management. Different tools for different requirements. I regret missing the sessions and hope to get links to the recordings. I do not regret the resumption of engagements and I hope that all of you peers are seeing eDiscovery life resume in our new remote normal mode.

*[Logikcull feedback/clarification – The In House presentation containing the metrics above did not specify that the 170 TB of hosted data referred to data processed between January to September 2020. They assert that they host ‘orders of magnitude more data than that’. That makes sense to me as the volume numbers seemed low. Logikcull also notes that my $3,250 processing/customer does not account for the ‘many hundreds’ of customers who are on subscription plans that reflect greater economies of scale. Valid points that a more specific slide would have made clear. I still feel that their overall customer profile fits the SMB market rather than large enterprise customers. However, I do expect that large enterprise customers will test the waters to see if they can achieve time and cost efficiencies for low volume dockets.]

Greg Buckles wants your feedback, questions or project inquiries at Greg@eDJGroupInc.com. Contact him directly for a free 15 minute ‘Good Karma’ call. He solves problems and creates eDiscovery solutions for enterprise and law firm clients.

Greg’s blog perspectives are personal opinions and should not be interpreted as a professional judgment or advice. Greg is no longer a journalist and all perspectives are based on best public information. Blog content is neither approved nor reviewed by any providers prior to being posted. Do you want to share your own perspective? Greg is looking for practical, professional informative perspectives free of marketing fluff, hidden agendas or personal/product bias. Outside blogs will clearly indicate the author, company and any relevant affiliations.