Several headlines and familiar names caught my eye as I skimmed my weekend feed. The founder of Vista Equity Partners (Robert F. Smith) announced a $140M settlement with the DOJ and the IRS while his long term Texas business partner Robert T. Brockman was charged with evading $2 billion in taxes, the ‘largest-ever’ tax fraud case to date. Vista’s co-founder Brian Sheth is said to be likely to be leaving the tech fund. So which eDiscovery companies took investments from Vista?

While tax evasion seems to be part of the billionaire investor’s playbook, this house of cards also includes allegations of $68M defrauded from other investors. The eDiscovery market has seen ever larger waves of investment that buoy up private legal tech/service companies who only disclose their revenue and other financial details when they need another round of funding. I have done multiple engagements for equity funds trying to evaluate potential ‘hot players’. Our market was founded on revenue from giant ‘bet the company’ matters or serial litigant verticals such as financial or pharma institutions. Our tech/SaaS providers have always promised better growth potential than their service provider peers. That 10x potential 3-7 year growth has tempted many private equity players and angel investors to invest without understanding our complex and dynamic market. At one point I was tracking the public announcements and even trying to back calculate market sizing from them. Now I just let Rob Robinson build his Complex Discovery list and turn down investment assessment requests that do not include a large retainer.

I imagine that the investigation and discovery focused on untangling Brockman and Smith’s custom encrypted email system, multiple mobile devices and other bread crumbs will be fascinating. I love the code names such as “Bonefish” and “Snapper”. They remind us all of Enron’s famous “Deathstar” and “Fat Boy” projects that came out in their email. Twenty years later and we are still entranced by the machinations of rich accused crooks. After all, it is our tax money that they divert to foreign banks.

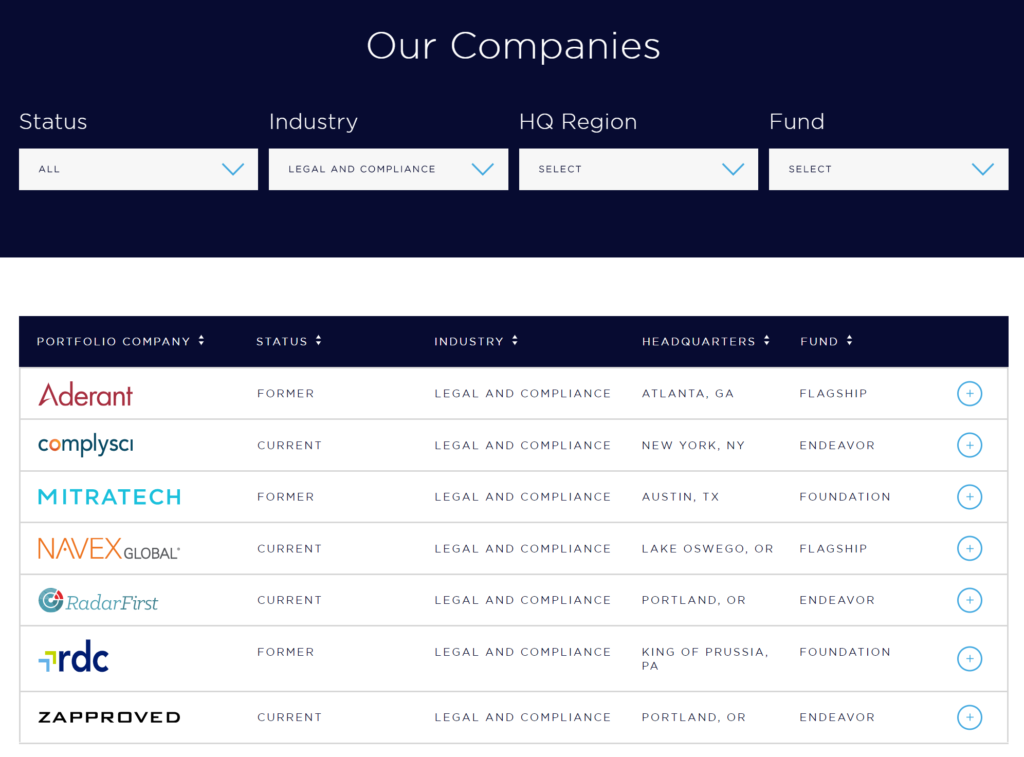

Should this matter to customers of Zapproved, Mitratech or Aderant? Mitratech in particular seemed to gobble up any potential competition before they could develop momentum to challenge them in the matter management space. Were they the best matter management solution? Not in my opinion, but they have held their dominant position and Vista got the return they wanted and sold off that part of their portfolio. The Vista Equity funding does not ‘taint’ a provider unless they somehow participated in the money shuffling game. That being said, it does indicate to me that their execs are comfortable swimming with the sharks or did not look too hard at who was backing them. While I would not advise a client to drop them from an RFP, I dig deeper into contract terms, reference customers and provider stability when I have reason to believe that their backers may pressure them for a high return on investment. So be an informed buyer and know who will be hosting your critical ESI or compliance systems.

Greg Buckles wants your feedback, questions or project inquiries at Greg@eDJGroupInc.com. Contact him directly for a free 15 minute ‘Good Karma’ call. He solves problems and creates eDiscovery solutions for enterprise and law firm clients.

Greg’s blog perspectives are personal opinions and should not be interpreted as a professional judgment or advice. Greg is no longer a journalist and all perspectives are based on best public information. Blog content is neither approved nor reviewed by any providers prior to being posted. Do you want to share your own perspective? Greg is looking for practical, professional informative perspectives free of marketing fluff, hidden agendas or personal/product bias. Outside blogs will clearly indicate the author, company and any relevant affiliations.