How to Reduce Outside Counsel Spend

Author: Casey Sullivan - Logikcull

… Seventy-three percent of general counsel were concerned about overspending on OC, according to the survey, which was based on responses from 167 in-house legal professionals. More than half of the surveyed legal departments had made it a priority to reduce outside spend in 2020...

… If in-house legal teams want to control outside spend, the biggest successes can be achieved through data reduction. Whether processing costs, hosting fees, or review costs, it all comes down to data...

… the vast majority of respondents to the 2020 Corporate In-Housing Survey were already pursuing internal data reduction efforts. Eighty-eight percent of respondents performed data collection in house, 78% culled that data through data filtering and keyword search, 63% deduped data in house, and 53% performed some in-house document review…

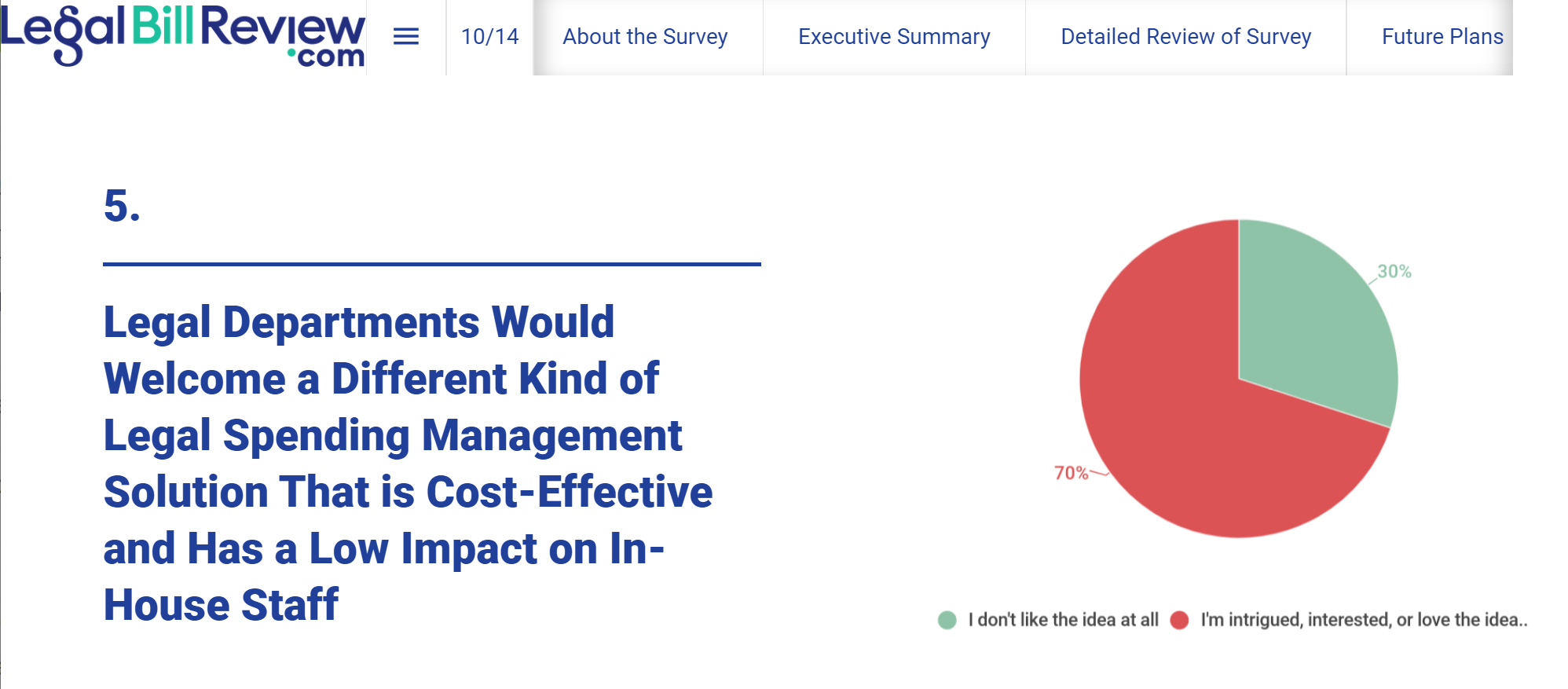

Question 5. From joint survey:

This blog relies on two of Logikcull’s surveys, 2020 Corporate In-Housing Survey (behind the contact wall) and a curiously untitled joint survey with LegalBillReview.com. As you might expect from the snippets, their message is that in-house legal teams are focused on reducing spend and can do so with their services. While I agree with the overall idea that reducing data reduces review spend, I have designed too many surveys to accept that either survey results fully reflect the broader US corporate and global markets. It is important to remember that Logikcull and other self-service eDiscovery platforms are aimed at the underserved SMB market. Smaller companies have to do more with less. Of the 167 respondents (a relatively large number) to the joint survey, only 10% spent more than $20 million on annual outside counsel bills. More than 32% of respondents were from highly regulated verticals (finance/telecom/pharma/etc.).

I am not trying to ‘throwing shade’ on the surveys or their sponsors. Rather I am exploring their context to better interpret the results. It is surprisingly easy to ‘lead’ respondents to your desired conclusion with well designed series of questions. Question #5 above is a good example of a loaded or leading question designed to elicit the 70% “intrigued, interested or love the idea” response. I believe that there is value in billing review. For many of my retainer clients I perform an annual review that deep dives into their largest matters. We typically find a lot of savings the first review. Is there value in having EVERY bill reviewed by a third party? Maybe for some of the largest serial litigants, but not for everyone. If you do not have a matter management system with e-billing such a service would ease your adoption of better spend management and almost certainly show an ROI. I guess my point here is to encourage you to look at the source, target audience and motivations of all market research. There is some good data in these surveys for a discerning reader. When eDJ Group was selling research we published the anonymized raw survey results along with our interpretations of them. I would like to see more of that now that I have to rely on other’s large scale surveys.