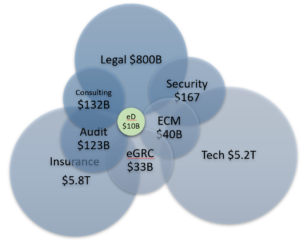

eDiscovery Related Markets

My thanks to the peers who took the time to question my belief that the eDiscovery market has always been undervalued or mis-defined in annual market sizing reports. I do not doubt the effort and diligence of analysts, marketing teams and consultants who have aggregated public and best available private revenue numbers from eDiscovery tech and service companies. Instead, I take the position that our global markets are so complex and intertwined that narrow player revenue does not properly represent the impact and runway of the global eDiscovery market. Back in 2008-2010 we explored creating an annual eDJ Group Mystical Matrix visualization and market sizing. I was tracking 800+ providers at that point. We were seeing global tech eDiscovery acquisitions by IBM, Microsoft, HP, CA and others that clearly valued eDiscovery functionality as a critical component in the data lifecycle. The cost of EDRM review tail has waived the Information Governance Rottweiler spend for a decade.

Maybe my experience playing different roles instilled a hyper awareness of how eDiscovery touches on so many other business verticals. eDiscovery tech and services are indeed tiny in proportion to the verticals that they influence. Back in the early decades (1990-2006) eDiscovery struggled for definition and recognition. Even then, I oversaw tens of millions in corporate eDiscovery spending from single companies. Every copy shop was reinventing itself and creating software to tackle the ever-expanding ESI repositories. Would we have created and sold billions in enterprise archiving without the sanctions and regulatory fines that resulted from early eDiscovery investigations into broker dealer communications?

There is no argument that HP’s $8.8B acquisition of Autonomy was a mistake. But I always thought that HP understood the potential market impact and just picked the wrong horse. Other large investors have made similar mistakes because they did not understand the complex and interwoven nature of legal technology and service companies. ESI now lives in the clouds and on our devices. That makes it increasingly diverse, accessible and challenging to manage. Fundamentally, eDiscovery is about trust and relevance. Without trusted access to relevant evidence, our legal and regulatory systems cannot ensure the functioning of our interdependent global economy. Legal and regulatory compliance are dependent on eDiscovery tech and services for monitoring, preservation and response actions.

There you have my argument that eDiscovery is one of many markets whose public/private revenue is just the tip of the iceberg above the water. The growth in self-service eDiscovery platforms like Logikcull, DISCO, etc. seems to demonstrate the demand formerly filled by small firms and shops. I believe that the vast majority of smaller and tangential eDiscovery tech/service players are not represented in the published market size numbers. All of this is the personal and professional opinion on an ex-analyst who no longer has to account to provider clientele. The big analyst firms seem to have chosen a safer, limited scope methodology that correlates to the prior metrics. Their YTY size and growth metrics have value for those monitoring the overall health of the market. Several peers have pointed out that the absolute size of the market is less important than understanding and predicting how a player will perform in that market. Public and private money seems to be predicting growth and performance for eDiscovery.

Showing my homework for related market size numbers in graphic:

Legal – $750-850B https://www.grandviewresearch.com/industry-analysis/global-legal-services-market#:~:text=How%20big%20is%20the%20legal,USD%20849.28%20billion%20in%202020.

ECM – $40B – https://www.marketsandmarkets.com/Market-Reports/enterprise-content-management-market-226977096.html

Security – $167B https://www.grandviewresearch.com/industry-analysis/cyber-security-market

Tech $5.2T https://www.comptia.org/content/research/it-industry-outlook-2020

eGRC $33B https://www.comptia.org/content/research/it-industry-outlook-2020

Can you find your favorite eDiscovery player?

Greg Buckles wants your feedback, questions or project inquiries at Greg@eDJGroupInc.com. Contact him directly for a free 15 minute ‘Good Karma’ call. He solves problems and creates eDiscovery solutions for enterprise and law firm clients.

Greg’s blog perspectives are personal opinions and should not be interpreted as a professional judgment or advice. Greg is no longer a journalist and all perspectives are based on best public information. Blog content is neither approved nor reviewed by any providers prior to being posted. Do you want to share your own perspective? Greg is looking for practical, professional informative perspectives free of marketing fluff, hidden agendas or personal/product bias. Outside blogs will clearly indicate the author, company and any relevant affiliations.

See Greg’s latest pic on Instagram.