Migrated from eDJGroupInc.com. Author: Greg Buckles. Published: 2014-06-23 20:00:00Format, images and links may no longer function correctly.

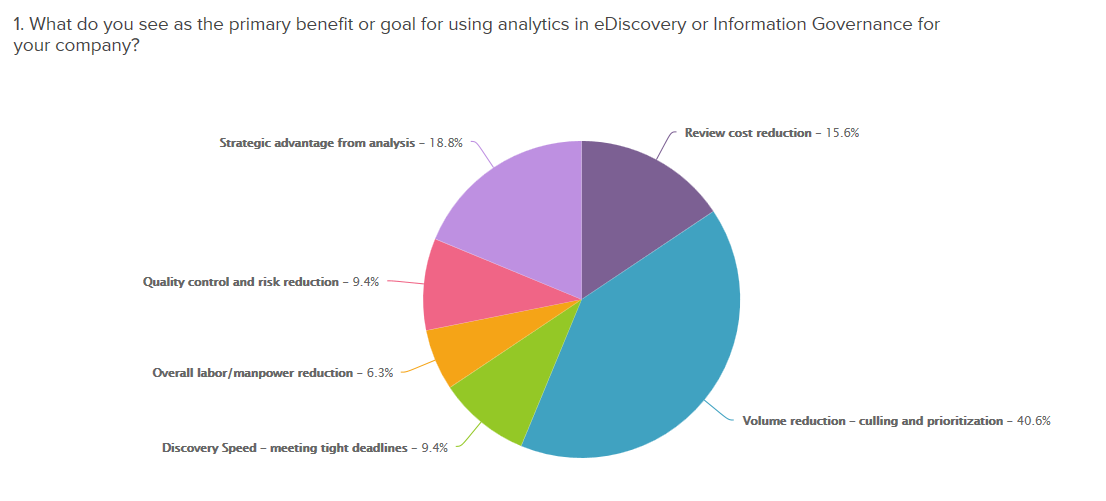

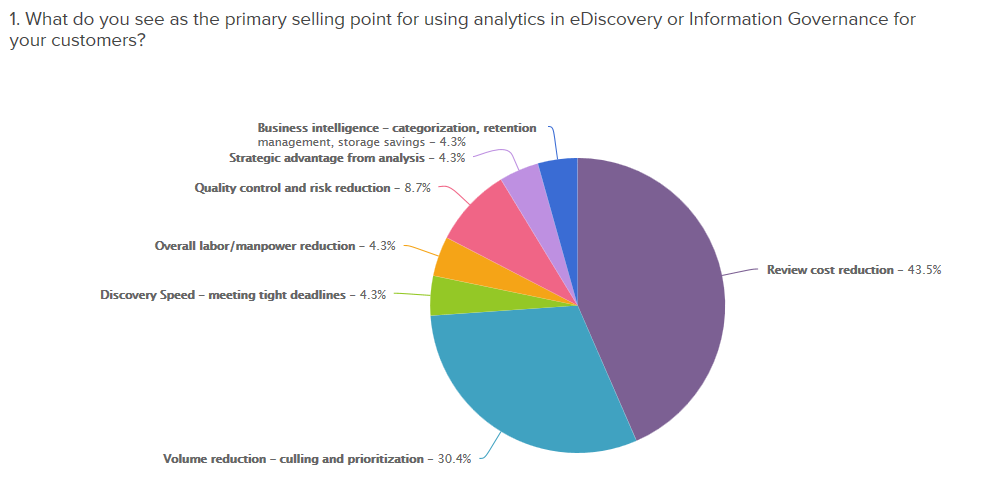

With over 50 survey responses and my first round of focus interviews under my belt, some trends are beginning to surface about how and why consumers and providers use advanced analytics. Early feedback and product briefings led me to launch separate consumer/provider surveys to better understand the different markets. The initial survey results have validated that decision, while I have tried to keep the 7 questions as close as possible to enable a merged market overview. The surveys will stay up for a couple more weeks while I go into another round of focus interviews. I target interviews for 15-30 minutes, but these keep running long with excellent insight from cutting edge practitioners. Right off the bat you can see below that providers and their customers have very different perceptions of the primary usage case for analytics.

Consumer Perspective – 32 Respondents

Provider Perspective – 27 Respondents

Providers seem to be laser focused on optimizing review efficiency, while my consumer interviews reflect a much wider set of drivers for analytics. This makes sense when you consider the classic service provider role, but it means that some providers can miss the early strategic opportunities to resolve or minimize discovery. I had several reports of short sighted providers and law firms resisting adoption of true Predictive Coding for reviews for a wide variety of reasons. The use of analytics to optimize linear review sets enjoys far more widespread acceptance, though providers and law firms report having to make the ROI justification for the additional processing costs in most cases. This ‘Accelerated Review’ methodology was pioneered by Attenex and Stratify more than 10 years ago and it is much easier for counsel to understand how decisions are propagated in clusters. This transparency lowers adoption resistance and avoids some of the potential seed set disclosure traps I heard about from sharp eDiscovery litigators.

The surprising figure from consumers is the almost 20% that see the primary benefit as the strategic advantage from analysis. My interviews expanded this answer with usage scenarios where firm and corporate lit support is expected to triage early collections from key custodians so that counsel can make the risk-liability-cost decision. This kind of early analysis has been at the heart of the ‘big data’ index providers who have been promising search and more from live data sources. Instead of performing ECA on the live systems, my respondents reported using targeted collections on key document sets and some optimized searches. The important story is consumers seeing value in resolving the case or the discovery as quickly as possible, rather than the traditional delaying tactics seen for too many years.

So take my survey and shoot me a note if you have 15 minutes to chat about what you are using analytics for.

Take eDJ’s monthly survey on Analytics Adoption for Consumers AND Providers to get premium access to profiles.

eDJ Group is proud to promote the Information Governance Initiative’s 2014 IG Annual Survey. We encourage you to participate and will share our insights on year to year trends when the survey is closed.

Join Greg in Houston at the upcoming ARMA International regional program on June 30. InfoGov: Getting Your Data House in Order to Avoid Litigation Costs and Risk.